CMC – Suriname Wednesday reached an agreement in principle with the Eurobond Creditor Committee on the restructuring of the country’s foreign bond debt.

The Ministry of Finance said that the restructuring of the so-called Oppenheimer debts creates considerable debt relief, because the loan is to be repaid over a longer period of time at lower repayments and interest.

According to the original loan, more than US$200 million should be paid immediately this year and US$600 million in 2026, which the government acknowledged was not feasible.

The Ministry of Finance said the new agreement has two instruments, namely a new bond and a Value Recovery Instrument (VRI).

The new bond will be issued with a 25 per cent haircut on the contractual receivables, and an interest rate of 7.95 per cent, which represents a significant reduction from the interest rates of 12.875 per cent due in 2033 and 9.25 per cent due in 2026 on the original Oppenheimer bonds issued in 2016.

Of the 7.95 per cent interest, 4.95 per cent has to be paid in 2024 and 2025, with the remainder being added to the principal.

Under the terms of the VRI, Suriname will in the future allocate a certain portion of the royalty income from the oil exploitation in Block 58 to compensate the bondholders for the losses incurred as a result of the debt restructuring.

The Ministry said contrary to some proposals to sell Block 58 before the realignment, under this deal, a maximum of two per cent of oil revenue from that block will go to bondholders. It said Block 58 will remain in control of Suriname and will continue to provide benefits to the country throughout its productive life.

The restructuring also offers Suriname the opportunity to buy back both the new bond and the VRI before their respective maturity dates.

The implementation of the restructuring is subject to agreement between Suriname and the bondholders on the final legal documentation and a Staff‐Level Agreement to be reached with the International Monetary Fund (IMF). This agreement with the Oppenheimer bondholders is an important milestone in the reconstruction and recovery of the economy.

Suriname is currently negotiating with the IMF to relaunch the stalled financing arrangements of the economic recovery programme.

Since mid-2022, the government has failed to meet the IMF’s programme conditions, causing the Washington-based financial institution to withdraw funds to the Dutch-speaking Caribbean Community (CARICOM) country.

In June, the IMF Board will review the recovery measures taken by the government and, depending on the outcome, it will seek to have a review of the economic situation here.

More Stories

PM Mottley issues statement on Drax Hall Plantation

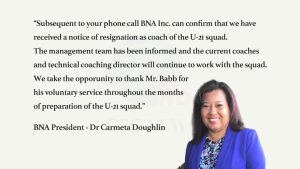

Babb quits as national U-21 netball coach

CBB taking action on issue of commercial bank fees