The Central Bank of Barbados has slammed the brakes on the efforts of a commercial bank to charge customers for online transfers to other banks or credit unions.

Just yesterday, Scotiabank informed customers that effective February 1, 2024, a fee of $1.25 will apply when they visit the branch or use Scotia online banking and the Scotia Caribbean app to transfer funds from their Scotiabank account to other local banks or credit unions.

Scotia noted that using real-time payments (RTP) and automated clearing house (ACH) transfers offers customers a convenient way to pay for many services.

The decision by Scotiabank to charge customers has provoked a swift response from the Central Bank.

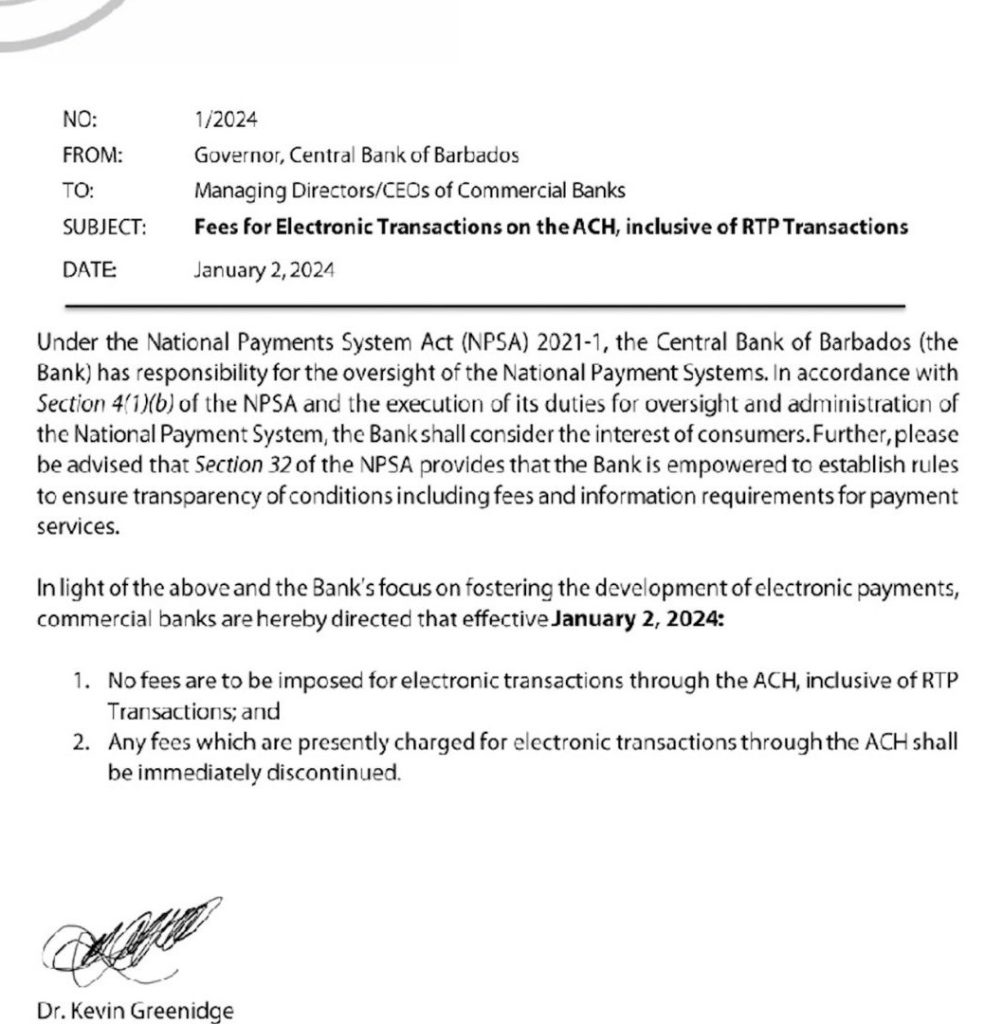

In correspondence dated January 2, and signed by Governor Dr. Kevin Greenidge, the Central Bank reminded commercial banks that under the National Payments Systems Act 2021-1, the Central Bank has responsibility for the oversight of the national payments systems.

The Central Bank further noted that under the act the bank is empowered to establish rules to ensure transparency of conditions, including fees and information requirements for payment system.

With that in mind, the Central Bank issued two directives:

One – that no fees are to be imposed for electronic transactions through the automated clearing house, inclusive of the real-time payment transactions.

Two – any fees which are presently charged for electronic transactions through the ACH shall be immediately discontinued.

More Stories

Talks underway to increase food production

Hundreds march in protest of Cybercrime Bill

CBC ensuring Bajans Feelin’ the Festival